Blog Details

บทความ /

Blog Details

Understanding the Pocket Option AML Policy 7

Understanding the Pocket Option AML Policy

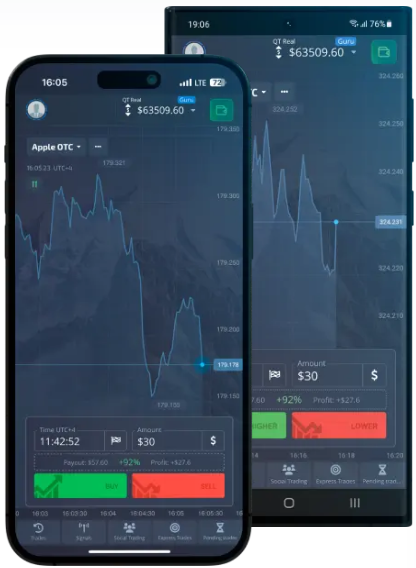

Anti-money laundering (AML) policies play a crucial role in the financial sector, ensuring that financial institutions adhere to legal requirements to prevent and detect financial crimes. One such necessary policy is the এন্টি মানি লন্ডারিং (AML) Pocket Option, which is implemented by Pocket Option, a platform known for its services in binary trading options.

What is the Pocket Option AML Policy?

The Pocket Option AML Policy is a strategic framework designed to combat financial crimes on the Pocket Option platform. This policy is implemented to ensure compliance with international regulations that aim to prevent the laundering of money through complex financial networks, guaranteeing the legitimacy of the trading environment.

Components of the AML Policy

The Pocket Option AML Policy encompasses several components vital for its effectiveness:

- Customer Verification: The process begins with the identification and verification of customers. Pocket Option mandates users to provide valid identification documents before accessing its services, ensuring that all users are who they claim to be.

- Transaction Monitoring: Continuous monitoring of transactions allows Pocket Option to flag suspicious activities. This automated process helps in identifying patterns that might indicate money laundering activities.

- Risk Assessment: The policy involves routine risk assessments to gauge the level of potential threats and adjust measures accordingly. By continuously evaluating risks, Pocket Option remains vigilant against evolving financial crime strategies.

Why is AML Important for Pocket Option?

The implementation of the Pocket Option AML Policy is vital for several reasons:

- Compliance with Legal Standards: Adhering to AML regulations ensures that Pocket Option is operating within legal boundaries, thereby avoiding legal repercussions.

- Maintaining Market Integrity: Effective AML measures help maintain trust among users and stakeholders by ensuring that the trading platform is free from illicit financial activities.

- Preventing Financial Crime: By effectively policing transactions, the policy minimizes the risk of the platform becoming a tool for money laundering.

The Implementation of Pocket Option AML Policy

Implementing the Pocket Option AML Policy involves a collaborative effort between technology and skilled human resources. The process includes:

- Advanced Technology: Utilizing state-of-the-art software to detect suspicious activities across the platform.

- Skilled Personnel: AML officers are trained to understand the signs of financial fraud and how to effectively intervene and report them.

- Regular Training: Continuous education and training of staff ensure that they are aware of the latest trends and techniques in money laundering and countermeasures.

The Challenges and Solutions in AML Implementation

The application of an effective AML policy, such as the Pocket Option AML Policy, faces several challenges:

- Evolving Crime Techniques: Criminals constantly develop new methods for laundering money. Pocket Option addresses this by evolving its own detection systems and strategies.

- Balancing Security and User Experience: Ensuring tight security can sometimes impact user experience. Pocket Option balances this by integrating user-friendly processes that do not compromise security.

Through these challenges, continuous innovation and vigilance stand as the primary solutions within the Pocket Option framework.

Conclusion

The Pocket Option AML Policy represents a proactive stance against financial crime, its structure and implementation reflecting a strong commitment to ethical and legal standards. By understanding and adhering to this policy, Pocket Option not only protects itself but also its clientele, fostering a secure and trustworthy trading environment.